NoLimit

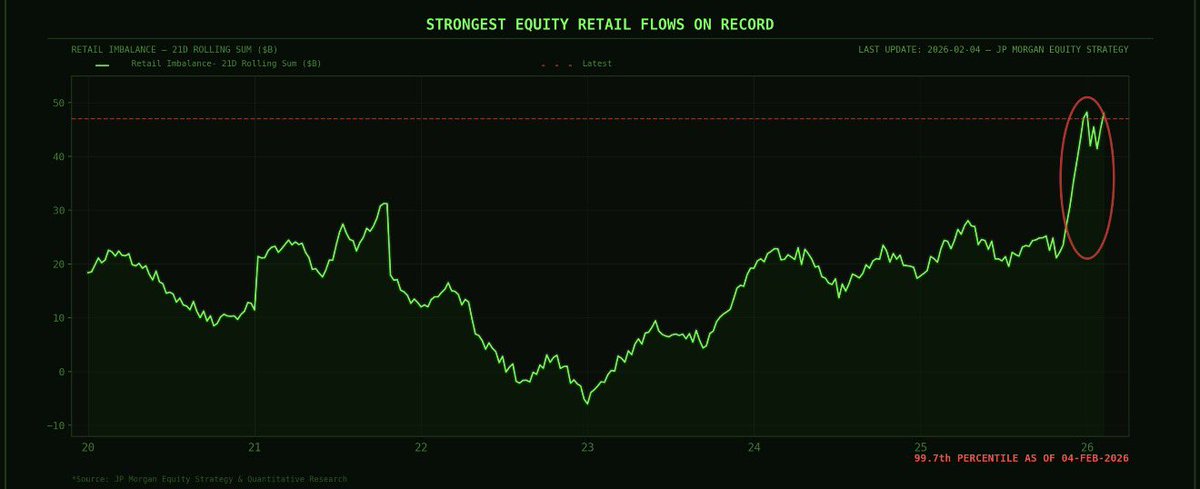

THIS HAS NEVER HAPPENED IN MARKET HISTORY Retail investors just bought $48 billion in stocks in 3 weeks. At all-time highs. And somehow nobody’s talking about how insane that is. This is the biggest retail buying spree ever recorded. Bigger than the meme stock era. Bigger than the pre-2022 crash buying. Bigger than anything. Quick reminder of what happened last time retail got this confident: they bought $33B before the 2022 bear market, then sold $10B at the exact bottom. Household equity allocation? 45-49% of financial assets. For context, the dot-com peak was 40%. We know how that ended. The cash on the sidelines thing drives me crazy. Sure, money markets hold trillions. But relative to market cap, that ratio is 0.19, the same as 2021’s peak. Actual bottoms? That number needs to be closer to 0.35. Meanwhile Wall Street has been dumping. $31B in net institutional selling in April while retail was buying hand over fist. Make of that what you will. Every single time households have gone this all-in on stocks, it’s ended badly. Every. Single. Time. My goal isn’t to scare you, but it’s my job to warn you when I see something unusual in the market. I don’t track prices, I track sentiment. I usually do the opposite of what the masses are doing. That’s how I bought every bottom and sold every top over the last 10 years. When the real bottom hits and I start buying heavy, I’ll say it here publicly. You will regret not following me. -

Read this slowly. Nobody is telling you the real function of a market crash. The consensus view is that volatility represents a market failure. But it doesn’t. In reality, it’s a feature designed for liquidity extraction. The fundamental paradigm of how fortunes are made is about exploiting panic. The truth? Every major drawdown, from the 57% crash in 2008 to the 34% drop in march 2020, was an engineered transfer of equity. Capital moved from reactive weak hands to disciplined institutional strong hands. Institutions have a luxury retail doesn't: Solvency. They aren't trading with rent money, so they don't have a ruin point on a standard correction. This liquidity buffer eliminates the emotional urge to capitulate. Here’s the mechanism they exploit every single time: 1. THE BIOLOGICAL FLAW Your brain is wired to fail in markets. When panic hits, your Amygdala screams "preserve capital," forcing you to sell at the exact moment risk premiums are most attractive. You crystallize losses at the bottom. 2. THE INSTITUTIONAL COUNTER-PARTY The big desks don't rely on sentiment, they use valuation models. When you panic sell, you are desperate for liquidity. They step in and provide it, absorbing your assets at deep discounts. 3. THE LAG TRAP Retail investors sit in cash waiting for the news to confirm it's safe. By the time the macro data looks good, the smart money has already driven the price up 30%. The optimal entry point has passed. If you’re waiting for an all clear signal from the media, you’re already too late. I’ve been tracking how the real money moves for the last 20 years. Price action lies, but order flow doesn't. The signal is in the dark pools and options gamma. Maximum fear + Institutional buying = the bottom. Don't overthink it. Just take the other side. BUT HERE’S THE THING… As of right now, the opposite is happening. Institutional traders (insiders) are selling everything at record levels, while retail investors think everything will do a 100x from here. I’ve been telling you for weeks, but I think a major correction is coming in the next few months. This market is being artificially sustained. When it finally breaks, it won't be a small correction, because we’re simply delaying the inevitable. As always, I promise to share all my moves publicly. I have an incredible track record and rarely miss. When I start deploying significant capital again because I believe the market has bottomed, I will share it here for everyone to see. Many people will regret not following me sooner. -

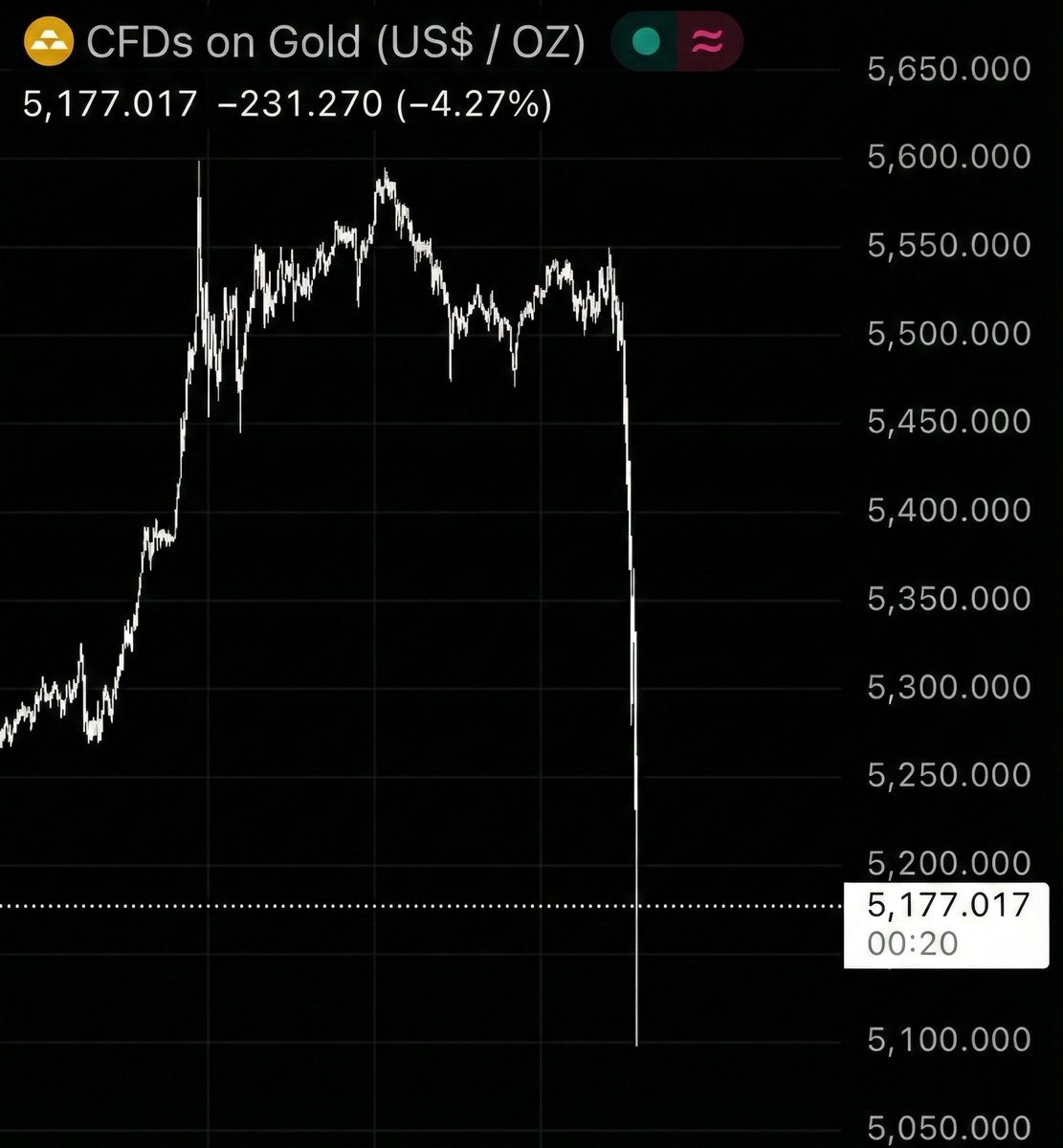

🚨 THIS IS ABSOLUTELY INSANE Gold and silver wiped out $5.9 TRILLION worth of market cap within 30 MINUTES. Do you understand how crazy that is? To put that in perspective, we just saw wealth equivalent to the combined GDP of the UK and France evaporate in less time than it takes to order pizza. This doesn’t even feel real. A move of this magnitude, in such a compressed timeframe, is far beyond a standard "6-sigma" event. It’s off the charts historically… Why are we seeing this? Extreme events like this almost always come from the market’s structure: instantaneous de-leveraging, cascading margin calls, collateral evaporation, and forced selling. We’re talking about massive internal strains in the system’s mechanics. Translation: THE SYSTEM JUST BROKE When precious metals, "safe haven" assets, vaporize trillions in minutes, they’re telling you, explicitly, that we are living through a real paradigm shift. The next few days will be INSANE, but don’t worry I’ll keep you updated like I always do. Btw, i called every market top and bottom of the last decade, and i’ll call my next move publicly as always. Many people will wish they followed me sooner. -